april 2016 service tax rate

042017 as below-1 Any booking solely for the purpose of accommodation by a tour operator has been removed from the category of Tour Operator which was previously taxed after 90 abatement It is suggested that in such cases a tour operator. From the 1st of June 2016 service tax is levied at 15 of the value of taxable services under Section 66 of the Service Tax Act.

Hicp At Constant Tax Rates Statistics Explained

132016-ST dated 1-3-2016 effective from 14th May 2016.

. From 142016 service tax is leviable on 30 on amount charged for service of transport of passengers by rail without availability of cenvat credit of inputs and capital goods. Cenvat Credit of Input Input Service Capital Goods used for providing the said service is not availed. 15 percent and 28 percent.

In case of small service providers whose value of taxable service did not exceed Rs. 82009 dated 24-02-2009 the Central Government exempts all the taxable services from so much of service tax leviable there on under section 66 of the Finance Actaudemars piguet replica as is in excess of. Krishi Kalyan Cess 05.

Earlier this is applicable for Services of goods transport agency in relation to transportation of goods. Penal Rate in case of tax collected but not deposited to exchequer. 22-01-2017 vide Notification No.

Swachh Bharat Cess 05. On the value of such services for the purposes of financing and promoting initiatives to improve agriculture or for any other purpose relating thereto. Increasing from 9 to 95.

Simple Interest Rate. 01062016 30062017 15 14 Service Tax 050 Swach Bharath Cess 050 Krishi Kalyan Cess Small scale exemption. The 15 includes 05 Krishi Kalyan Cess and 05 Swach Bharat Cess.

Increasing from 8625 to 9375. Service tax is only liable to be paid in case the total value of the service provided during the financial year is more than 10 lakh US13000. The Rate of Service Tax on Tour Operator Service has been changed wef.

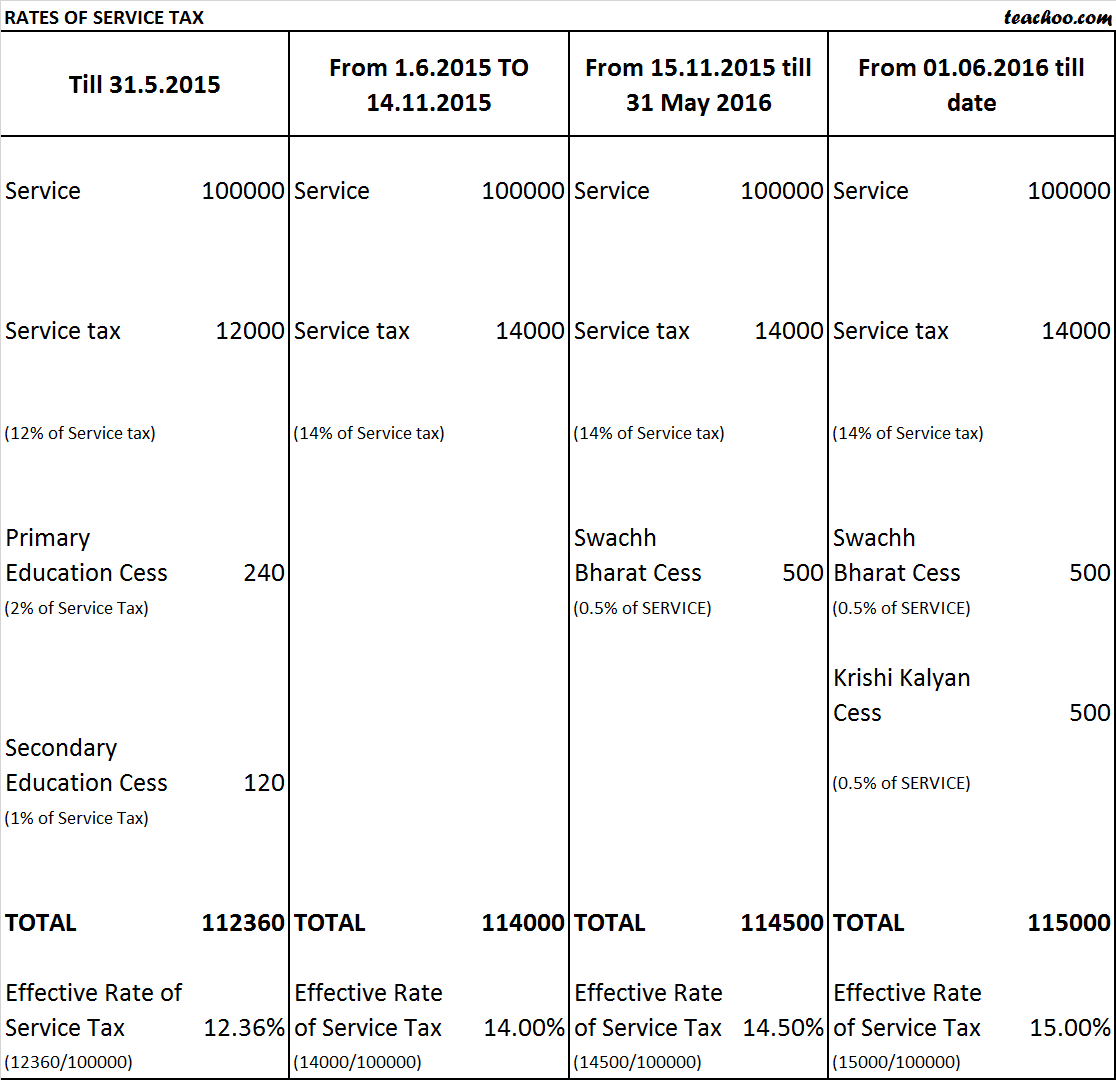

The Finance Bill 2015 proposes an increase in rate of Service Tax from 1236 to 14. The rate of 14 shall be effective from a date notified after the Finance Bill 2015 gets assent of the President and is enacted finally. In 2016 the Union Budget of India proposed to impose a cess called the Krishi Kalyan Cess at 05 on all taxable services effective from 1 June 2016.

8 rows April 2016-Sep 2016 April-May 145 July-Sep-15 Oct 2016-March 2017 Oct-March 15. Service Tax Basic Rate -14. Invoices raised on advances before 30th May 2015 for future services could be paid at the old service tax rate of 1236.

New Service Tax Rate effective from 01-06-2016 After enactment of the Finance Act 2016 No. Cenvat credit on input input services and capital goods are not available. The Said change will be effective from.

20 of 2015 the Central Government hereby appoints the 1st day of April 2016 as the date on which the provisions of sub-section 1 of section 109 of the said Act shall come into effect. The last service tax rate was 15 it can be simply be divided into 3 parts. 2 There shall be levied and collected in accordance with the provisions of this Chapter a cess to be called the Krishi Kalyan Cess as service tax on all or any of the taxable services at the rate of 05 per cent.

As shown above Swacch Bharat Cess and. The Said change will be effective from 1st June 2016. Tax Rates 2016 1 For Tax Years 1988 through 1990 the tax rate schedules provided only two basic rates.

C urrently Service Tax is levied at the rate of 12 vide charging section 66 of the Finance Act 1994 Chapter V However vide Service Tax Notification no. 18 rows 600. If invoices are raised before June 1st 2016 for services to be provided after June 2016 then the service tax rate applicable is 14.

If a new levy is introduced like Krishi Kalyan Cess or a service taxed for first time then Rule 5 is to be referred. However if assessee has collected service tax but did not deposit it with Government interest rate will be 24 Notification No. The 15 includes 05 Krishi Kalyan Cess and 05 Swach Bharat Cess.

Service tax rate increased from 145 to 15 increase by way of levying Krishi Kalyan Cess at 05. So all goods including household goods were covered. City of Greenfield Monterey County.

16 rows Rate of Service tax would eventually increases to 15 wef. Service Tax Interest Rates wef 14052016 Other than in above situations. You may also like to read Chapter V of Finance Act 1994.

Cenvat credit of input services are now available. Increasing from 75 to 8. New Service Tax Chart with Service Tax Rate of 15.

For the tax payers with value of taxable service less than 60 lakh rupees in PFY interest rate for delayed payment will be 12. Service tax rate increased from 145 to 15 increase by way of levying Krishi Kalyan Cess at 05. After levy of KKC.

City of Dunsmuir Siskiyou County. Simple Interest Rate 15 NOTIFICATION NO132016-ST DATED 1-3-2016 Service Tax Interest Rates on delayed payment of Service Tax in case of assessees whose value of taxable services in the preceding yearyears covered by the notice is less than Rs60 Lakh. Swachh Bharat Cess 05 wef.

City of South San Francisco. 01-06-2016 is increased from 1450 to 15 14 ST 050 Swachh Bharat Cess 050 Krishi Kalyan Cess by way of introducing Krishi Kalyan Cess 050 on value of taxable services. The service tax rate may get changed by Budget 2016 from 145 to 16.

Several local sales and use tax rate changes are scheduled to take effect in California on April 1 2016. In exercise of the powers conferred by section 109 of the Finance Act 2015 No. The Education Cess and Secondary and Higher Education Cess shall be subsumed in the revised rate of Service Tax.

60 lakhs during any of the financial years covered by the notice or during the last. 28 of 2016 the effective rate of Service Tax wef. However taxable income over certain levels was subject to a 33-percent tax rate to phase out the benefit of the 15-percent tax bracket as compared to the 28-percent rate and the deduction for personal exemptions.

Basic Rate 14.

Image Result For Gst In Other Countries List List Of Countries Country Other Countries

Rescinding Of Notifications Under Certain Sections Of Mvat Http Taxguru In Goods And Service Tax Resc Goods And Services Goods And Service Tax Indirect Tax

Service Charges Invoice Or Service Bill Creation In Tally Erp 9

Gst Exemption List Exempted Goods And Services Under Gst Indiafilings

What Is The Rate Of Service Tax For 2015 16 And 2016 17

If Petrol And Diesel Are Brought Under Gst They Ll Have To Be Taxed At More Than 100 Mint

Gst Implications In Case Of Joint Development Agreements

Corporate Income Taxes In Canada Revenue Rates And Rationale Hillnotes

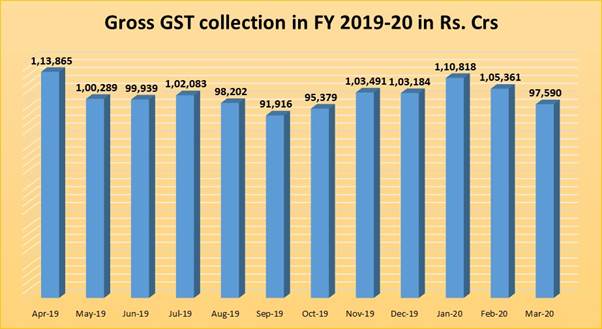

Gst Rates 2020 Complete List Of Goods And Services Tax Slabs

Meaning Of Sgst Igst Cgst With Input Tax Credit Adjustment Sag Infotech

How Is My Tax Collected Low Incomes Tax Reform Group

Pan Card Fees For Indians Rs 101 Inc Tax 2022 Check Reprint Fee Online

Gst Rates 2020 Complete List Of Goods And Services Tax Slabs

Latest Post Office Interest Rates April June 2021 Basunivesh

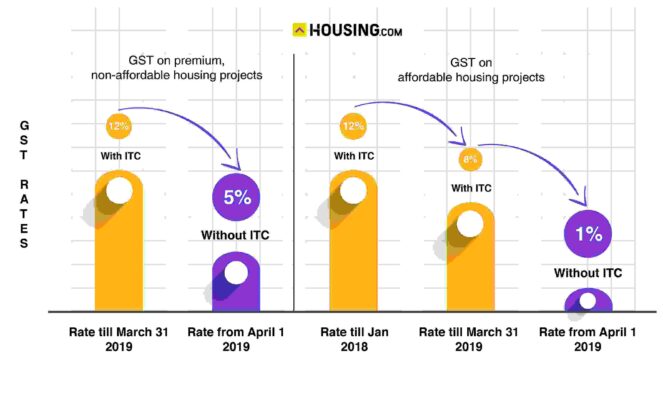

Gst On Flat Purchase Real Estate Rates In 2022 Impact On Home Buyers